Well, a little late, but better than never.

January definetly proved to be an interesting month, with the market dipping 5-7%, a lot of the options premiums became less appealing as my buy in prices and the actual stock prices seemed to be continually be moving apart, ha. At any rate, just pushed some options out a little longer than I typically do to collect at least some premiums, and put those earnings back into my accounts, is essence doubling down a little and lowering some cost basis on stocks I like (VZ and F).

So Jan didn't end up to be the hot start I was hoping for, but Feb is looking to be better (half a month in now since I'm late on this post), the market is going back up and both VZ and F pay dividends to start and end the month.

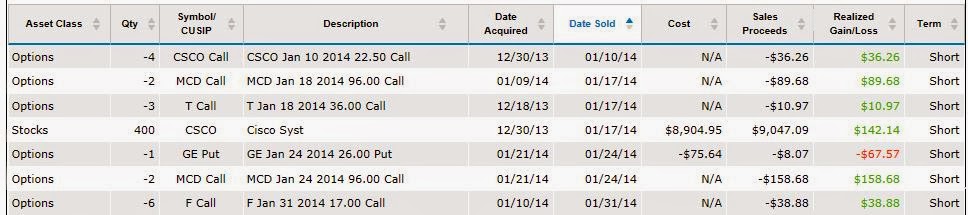

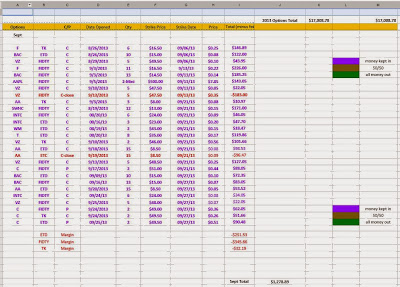

My totals for Jan were below, for a total of $1625.53 in short gains (options + cap gains from option stocks) not a bad start considering the market, but have some ground to make up for sure if I want to make my goal for the year.

I added two pics at the end that I thought interesting. Even though the market turned down in Jan, with the dividends and option premiums I received, I was able to "soften" the blow vs the normal market, just another added benefit of using this strategy.

The Dividend/Options Addict

I love dividends. I love options. Some say you can't be a fan of both, I disagree. I utilize both strategies to complete a CONSERVATIVE, balanced approach to making my investments grow.

Wednesday, February 12, 2014

Monday, January 6, 2014

2014 Goals And Rules Of Engagement

After what I consider a pretty successful first full year of options trading, a new year brings a time to look back, tweak things, and set goals and procedures for the next year.

My goal for 2014 is pretty simple, I would like to generate 45K in options/short term capital gains this year. This will take some smart trading, along with adding additional capital to my account by saving more, but I think it can be done. I would be very suprised if I'm at 20K by June, but think I can play catch up the second half of the year as that's when the seasonality of my job allows me to stash more cash away. So there you have it, one singular "goal". 45K or bust.

That being said, I am going to change up my rules of engagement a little bit. This year I really didn't follow any protocol with my "earnings" from the options. Some I would simply leave in the account, at other times I would pull out and use as disposable income, there really was no rhyme or reason to what I did with the earnings. So here is a system I have devised to follow this year.

1. I will split the money I earn on options that expire worthless 50/50. 50% will stay in the account, and 50% will be pulled into my banking account. Dividends collected on stocks I own with options on them will for the most part be auto-dripped into additional shares. The few stocks I own that I don't auto-drip will be split in the 50/50 ratio as well.

2. From there I will use the 50% of the money transfered to my bank to pay off whatever debt I would like to target. I currently have a balance on a credit card I would like to clear up (gets close then I seem to put another purchase on it), a new car payment, and the ever present college loans. Applying this extra income to those balances should accelerate the payment pay off schedule, and hopefully get the credit card and the car (almost) paid off by the end of the year.

3. The other 50% I will tally at the end of the month, and initiate a monthly purchase into a dividend growth stock I may own already or start a new position in a stock I want to own (in the TradeKing account I am trying to actively grow), thus generating more income with a potential for capital growth.

By following these steps, I will be paying down debt as well as investing for the future at the same time, and I think this could be a very efficient strategy. It will add a little more book keeping on my end at the end of each month, but I think as I see the balances go down on the few debts I do have, it will keep the motivation up.

So there you have it, my game plan, and now that it is written down, it's just a matter of following the steps every week the options (hopefully) expire worthless. Let the games begin!!

Tuesday, December 31, 2013

December 2013 Options

Happy Holidays Everyone,

December proved to be an interesting month to say the least, but it goes to show how options can still help out in adversity.

CSCO and F both had a rough month on revised guidance, each having a modest drop over the course of a couple of days. Being that I have a larger portion in both, the cov'd calls at the strike prices I want to be above were not as lucrative as when the price of the stock is closer. (Ie around 22.50 for CSCO (which now has risen back) and F in the 16.75 range). That being said I had to sell some longer running cov'd calls so my monthly total wasn't as high as it could be (they will be expiring in Jan) but I still managed to make $1393.26 of profit.

SWHC also had a strong month, which is normally a good thing, but I was in a $13 Dec 23rd covered call, with my stock avg cost of $13.55. So even after the .30c premium on that one, I took a couple hundred dollar hit when I had to sell them with .25c loss per share (1200 shares)

So that brings my total for 2013 to $33,790 (aprrox) of profit on options (short term). I am pretty excited/pleased with that as this is my first true year of doing them. I made many, many less "rookie" trades (ahem mistakes) this year, than when I started in mid 2012, and now that I have a comfort level with what I'm doing, I'm looking very forward to many years of success and increasing yearly totals.

2014 looks to be a great year and I have some goals as well as new guidelines I am going to post about, but that will be after the new year. Enjoy the New Years celebration and we'll catch you in 2014.

Tuesday, December 3, 2013

Nov 2013 Options

November was quite a busy month, with 5 Fridays in the month it meant an extra week of weekly option trading, even if Thanksgiving week was included in there.

For Nov, I was able to generate $2972.58 in total option income, which I'm very pleased with. Was hoping to break the $3K mark, but that is a number that I'm sure will be hit in the future. Overall the options, along with some of the short term capital gain I saw from the options (Citigroup -C, in particular), it turned out to be a very profitable month. As indicated by purple, I kept ALL option earnings in the accounts for the month. (Didn't take any as profit to use)

Including my Nov options income, my yearly total from options (short term) so far is: $32,667.00. The options, along with the short term capital gains from the stocks made Nov a $4724.00 total profit month.

Here's hoping that December will be just as successful, until then Happy Holidays!

Tuesday, October 29, 2013

October Options Total

October turned out to be a roller coaster month and I didn't get as much income as I was hoping to secure. Got a few strike prices below on some of my positions early in the month when the markets dipped (low premiums for the strike prices I needed to be at to prevent a capital loss if sold), only to finish strong with some nice call and put premiums as the markets closed out Oct on a run. My total for Oct was $1335.00 in option income.

The $1335.00 in Oct brings my 2013 options total income from all accounts to $27,943.00 (est) for the year so far.

I will be able to add more capital to my dividend holdings in the next week or so (which in turn will be more margin for option stocks), as well as getting some dividend payouts on stocks thats I'm using solely for options (VZ and T), so I'm expecting Novembers total return to be much higher. Should be my most lucrative month since starting this strategy and I'm looking forward to seeing how it plays out.

Wednesday, September 25, 2013

Sept Options Total

September's earnings were down due to a few reasons. I decided to change my strategy a little (feeling the market would uptick) and go for a little more capital gains at the cost of juicier premiums (ie going next price up for a lower premium in hoping to catch the stock price rising), I have had mixed results so far doing this. I think in October I'm going to go back and try and get as little capital gains in exchange for better premiums, and see how much option income I can generate (without losing profit by selling below avg price points obviously).

So for Sept, total income looked like this:

We'll see if we can get back above the $2K mark for next month.

-The Dividend Addict

Thursday, February 7, 2013

Jan 2012 Options

Review of all my options for the month of Jan. For the month I brought in $2872.00 of passive income from stocks I already own and/or using margin to cover puts on stocks I'm waiting for the price to come down on.

Subscribe to:

Posts (Atom)